Is A Home Security System Tax Deductible

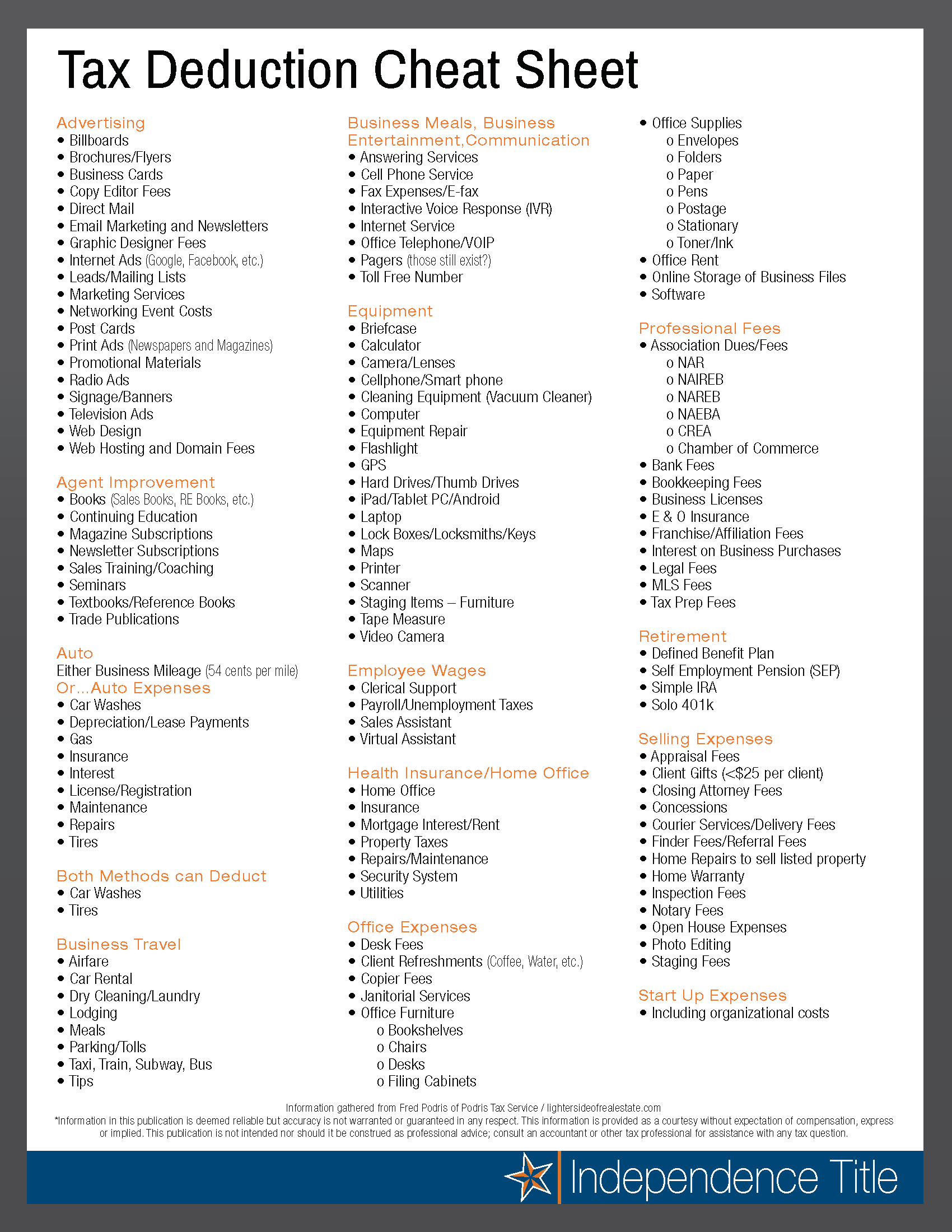

Is a home security system tax deductible. Surprising tax-deductible costs variety from protecting dogs from gambling losses and extra. When you do your taxes you report deductible home-business expenses on Form 8829. You can receive a tax deduction if you purchase mortgage points upfront.

Home security is not inherently tax deductible but if you work out of a home office there are ways you might be able to get at least partial credit for it. We understand youre wanting to save money which is why we have a great deal of terrific choices for security systems. You may qualify for the IRS Home Office Deduction Repairs and improvements made to your workspace may be partially deductible if you are directly impacting your workspace like replacing an office window or fully tax-deductible if benefiting your entire home like a heating system repair.

One way to offset the expense is by reducing the amount of income tax a senior owes the Internal Revenue Service IRS on a yearly basis. Most of the business are currently participated in making top quality home security system for individuals. Homeowners want to get every tax deduction theyre entitled to.

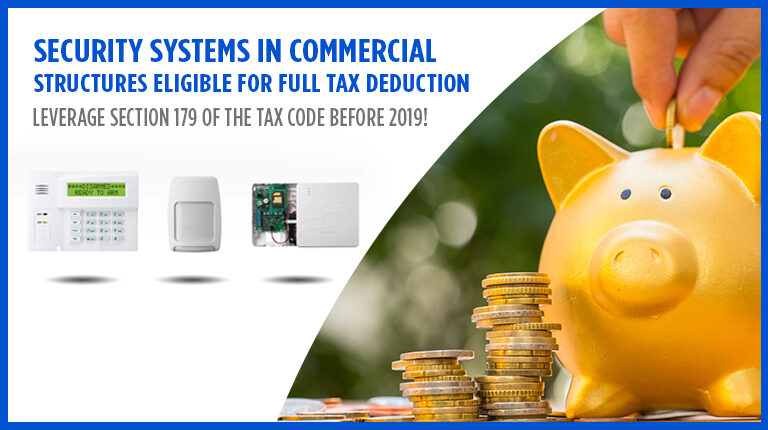

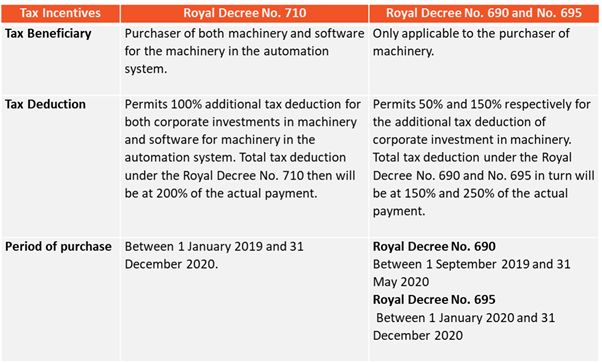

You may be able to deduct it however if you have a home office that qualifies as such under IRS guidelines. Therefore in this instance you cannot deduct the cost of installation and monitoring associated with your home security system. The good news is that both equipment and installation costs can be deducted under Section 197.

However if you claim a home office or use your home for a business like a child care facility you may also be able to claim a portion of your home security system. There is no tax deduction for installing an alarm system at your home for non-business related reasons. They are innovative and of top quality that it can easily give the most effective service to individuals.

As well as a great deal of the systems on the market now are Do It Yourself indicating you can mount them and also even. If your security system is only used to safeguard your personal property then it would fall under the Internal Revenue. Below is an example of how much a business may save if they purchase a security system at a total cost of 25000 in 2021 and subsequently take the tax deduction.

Security Systems Is A Home Security System Tax Deductible. As a caregiver or family member you may well be wondering whether the medical alert system that your beloved family member has is tax deductible.

As a caregiver or family member you may well be wondering whether the medical alert system that your beloved family member has is tax deductible.

Is my Home Security System Tax Deductible. When you do your taxes you report deductible home-business expenses on Form 8829. If your security system is only used to safeguard your personal property then it would fall under the Internal Revenue Services IRS list of nondeductible expenses. A home security system keeps you and your family safe but is generally not fully deductible. However if you claim a home office or use your home for a business like a child care facility you may. If your home security system is only used to secure personal property only it falls under the IRS list of nondeductible expenses. Home Security Systems Installed for Personal Use. The answer isnt an easy one. You transfer that amount to Schedule C for self-employment income and expenses.

You transfer that amount to Schedule C for self-employment income and expenses. The good news is that both equipment and installation costs can be deducted under Section 197. One way to offset the expense is by reducing the amount of income tax a senior owes the Internal Revenue Service IRS on a yearly basis. But as taxpayers nationwide scramble to calculate their last-minute deductions to maximize this yrs refund some might be disillusioned to discover that a domestic protection system is not one of these qualifying objectsbesides in one special case. According to IRS publication 529 security systems used solely to protect a home are not deductible. The answer isnt an easy one. Typically though a home security system does not qualify for a tax deduction.

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

Post a Comment for "Is A Home Security System Tax Deductible"